In Finland, it is possible to engage in business activities through the following company types: sole proprietor ("business name", tmi), partnership (ay), limited partnership (ky), limited company (oy), cooperative or branch of a foreign company.

Note! You can choose English subtitles in the video settings.

A company pays income tax based on the company's taxable income, income taxes are paid in advance. Company type affects taxation.

Value Added Tax is a consumption tax that the seller includes in the sales price of the product or service. Almost everyone who sells goods or services as a business is liable to pay VAT (with the exception of health and medical services, social welfare services and financial and insurance services; these are specifically provided for in the VAT Act). The general VAT rate is 24%, and company type does not affect VAT.

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

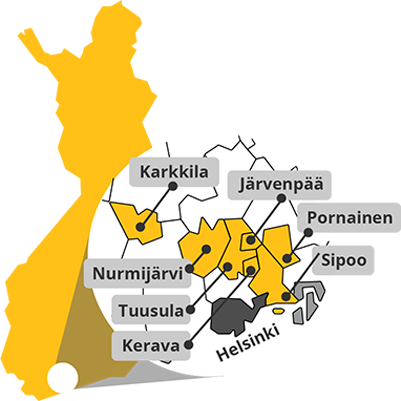

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy