A company’s financing typically comes from three sources: the entrepreneur’s own funds, loans and possibly grants. Loans are mainly granted by commercial banks and the state-owned financing company Finnvera, which also offers guarantees that can be used as collateral security for other lenders’ loans.

If you intend to become a full-time entrepreneur, TE services may also award you a startup grant of approximately 700 €/month. The preconditions for receiving the startup grant include e.g. being a full-time entrepreneur, having adequate capabilities for the intended business and having potential for continued profitable operation. The business must only be started once the decision regarding the grant has been made.

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

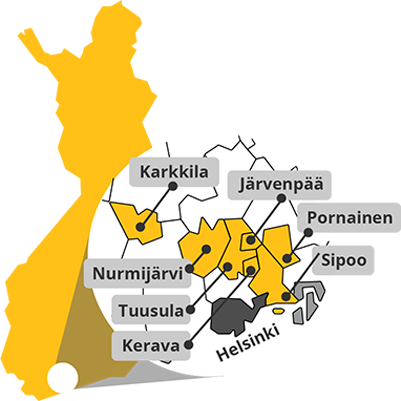

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy