When a business begins to pay wages on a regular basis, it must report to the Finnish Tax Administration’s register of employers using a start-up notification form or a change notification form (if the company already has a business ID). Once the company is in the register, the Finnish Tax Administration will send the company instructions on how to pay and report taxes withheld in advance and social security contributions.

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

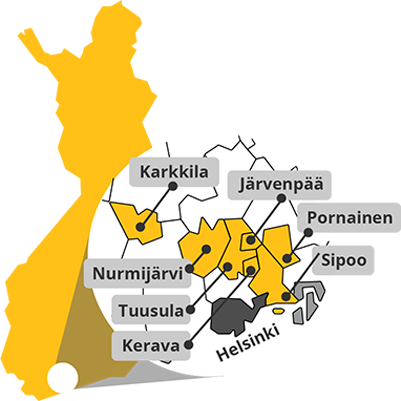

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy