It is a good idea to plan the financing of your growth plans well in advance. A fast take-off requires resources, and even at a slower pace, growth is still not free. Growth funding needs to be planned so that the company’s growth and development stays under control. Oftentimes, external financing is needed in addition to the company’s own funds. It is possible to apply for public growth and internationalization funding. Public operators provide loans, subsidies and investments, but to get these you do need some internal financing as well. In general, the business must be aiming for significant growth to be eligible for these types of funding.

There is no perfect solution – a financing package typically consists of funds provided by more than one operator. We will help you evaluate your business’ financing needs as well as your chances of receiving financing and subsidies. We will also help you prepare financing applications and obtain the necessary attachments (including financial statements, profit forecasting and business plan clarifications).

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

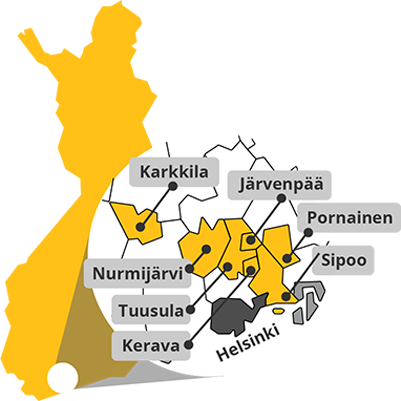

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy