01 Nov 2019

Bring your invoicing up to date

If you have fallen behind on your invoicing, now is the time to get your affairs in order. All of the work done before the turn of the year and possibly the new financial year should be allocated to the correct year. Timely invoicing is also part of the good service you provide your customers and ensures an up-to-date invoicing cycle and a steady cashflow.

Prepare for the new year

It is high time to start thinking about the new year. Use a circular calendar for planning your year. You can create dedicated circular calendars for the day-to-day business, finances, campaigns, and marketing. When creating a circular calendar, the most important thing is writing things down to ensure that you are actually going to carry them out. Including your personnel in the planning ensures that you have dedicated and enthusiastic workers to implement your plans.

You can download a circular calendar template HERE

Budgeting for efficiency

Budgeting is a good tool for planning the new year. It is not just a prediction of your company's income and expenses, but also an operational plan that outlines the operation of your entire company. In smaller companies, creating a budget is not mandatory, but it does increase awareness of costs and provide ambitiousness for cashflows. Thus, you should definitely plan out the upcoming year in monetary terms as well.

Preparing for the financial statements

If your company's financial year comes to an end at the end of December, you should make an appointment with your accountant right now. The early part of the year is the busiest season for accounting firms.

Make yourself a checklist of all the information and documents the accountant will need for the financial statements. Go through the list with your accountant, as they will know which of the listed items pertain to your company.

Keuke will gladly help you with any of this as well. Book an appointment keuke (at) keuke.fi, 050 341 3210.

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

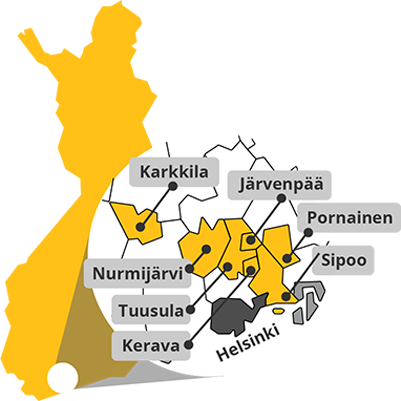

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy