01 Jul 2020

1. I am in the process of making an equipment investment in the region of 20,000 euros. What would be the best way to finance this investment? Should I use cash assets?

This depends on the situation and strategy of your company and the nature of the investment. Investments can be financed using the company’s cash assets or with debt financing. If you do not want to use cash assets for an investment or if you are lacking the necessary security, you could lease the equipment or pay it in installments.

If you want to own the machine or piece of equipment, payment in installments or a loan is the right option for you. Leasing is often the most expensive form of financing, but its benefits include being fully aware of the cost of financing and the fact that you do not need security. In accounting terms, leasing improves your solvency and is particularly applicable for situations where the acquired machine or piece of equipment rapidly loses its value.

2. Is it possible to seek funding from several different financiers for the same investment? What is the most common way of seeking and receiving funds?

Of course. You should first contact your bank and examine the different options available. We at Keuke can also help you examine investment aids and produce funds statements.

3. How does Finnvera funding differ from bank loans?

Finnvera provides funding for business operations based on good business ideas that meet the requirements for profitable business. Finnvera’s funding principle is to share the collateral risk related to funding with other financiers, such as a bank. Thus, you should start by negotiating with your bank on finances.

Finnvera has remodeled its products and now its primary recommendation for companies that have been operating for more than three years is Finnvera’s SME Guarantee for which your bank applies on your behalf. The product is intended as a guarantee for various funding needs, such as investments or operating capital as well as funding required for business acquisitions. Finnvera’s decision to grant a guarantee is based on the bank's assessment of the growth potential of your company. The corresponding product for companies less than three years old is called Start Guarantee and it is similarly applied for by the bank on behalf of the entrepreneur.

4. What public investment aids are available at the moment and for whom are they intended?

Companies in rural Finland can apply for investment aid for various investments. Investment aid can be granted for, among other things, acquiring or building production facilities, purchasing machines or other fixed assets, and for intangible assets such as software patents, and production rights.

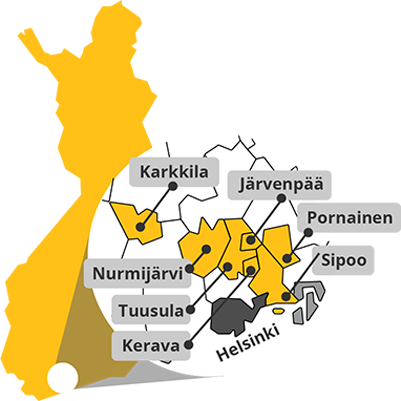

Within Keuke’s operating area, the level of support is 20 percent and certain preconditions are applied to the aid in terms of the location and size of the company and the nature of the investment, for example. These should be discussed with a Keuke business developer during the planning of the investment.

5. How should I prepare for investments and funding them?

Contact Keuke and we can review your investment plans, map out suitable funding options, and produce the necessary calculations and possible applications together.

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy