18 December 2020

The State Treasury will open the electronic service for applying for fixed-term cost support for companies at 9 am on Monday 21 December 2020.

Cost support is intended for companies whose turnover has decreased by more than 30% due to the pandemic in June-October 2020 compared to the reference period in 2019. If the company was established on 1 May 2019 or after, the reference period is from 1 January to 29 February 2020.

It is not necessary to rush to apply immediately at the start of the application period to receive cost support; Cost support is regulated by legislation which means that all companies that meet the requirements for receiving the support and apply for it during the application period will receive the support. You can apply for cost support from the State Treasury until 26 February 2021.

The sectors that fall within the scope of the support have been defined in the Government Decree today on 18 December. The list of sectors defines the sectors at which the support is targeted and which have been affected by corona. The list of sectors helps consider other possible reasons why the company’s turnover has decreased. These include seasonal fluctuations in the company’s turnover or a drop in turnover due to reasons other than the coronavirus epidemic.

The company can see the State Treasury’s website for the sectors that are eligible for cost support under the Decree.

However, if the sector of the company does not fall within the scope of the support under the Decree, the company may apply for cost support if its turnover has fallen by more than 30% due to corona in June-October 2020 compared to the same time period in 2019. The company must demonstrate particularly serious grounds to show that its turnover has decreased because of corona. For example, a restriction or order that has made it difficult to engage in a business can be considered a particularly serious reason.

In order to qualify for the support, the company’s turnover must have fallen by more than 30% compared to the reference period. The State Treasury receives information on the company’s turnover from VAT reports that the company has made to the Tax Administration or, in the absence of these reports, from reports submitted by the company itself.

The State Treasury has launched a calculator on its website to assess whether your company is eligible for the support. The calculator can only give rough estimates and its result is not yet a formal decision on cost support but the support must be applied for separately through the e-services.

Before applying, make sure that you have all the information available that is required to complete the application. This information includes:

The State Treasury receives the company’s other financial and salary information from the Tax Administration and the Incomes Register.

First, check to see if your question has already been answered on the FAQ page or on the cost support service pages.

If you can’t find an answer to your question, you can get advice on the cost support service phone and chat services. The phone service is open on weekdays from 9 to 15 at 0295 50 3050. The chat service is available for those logged in on the service channel.

The State Treasury’s website will also soon have a video that helps you fill in the application.

Cost support applications and decisions are published on the State Treasury’s website. On the website, you can follow the processing of your application or find information on applications and their processing. The first statistics on the application process will be published before the end of the year.

Timo Laitinen, Director, tel. +358 40 060 3561

Jyri Tapper, Head of Division, tel. +358 295 502 950

Tuomo Yliluoma, Service director, tel. +358 295 503 349

Do not hesitate to contact us and book a free appointment! You can also contact us using the contact form below.

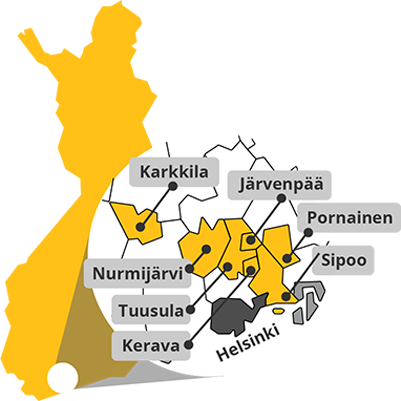

Keski-Uudenmaan Kehittämiskeskus Oy

Business Development Centre Ltd. Helsinki Region North

Puuvalonaukio 2D, 2. krs, 04200 Kerava

![]()

050 341 3210

![]()

keuke@keuke.fi

Synergia Foxy

Synergia Foxy